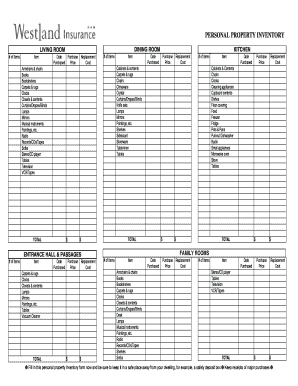

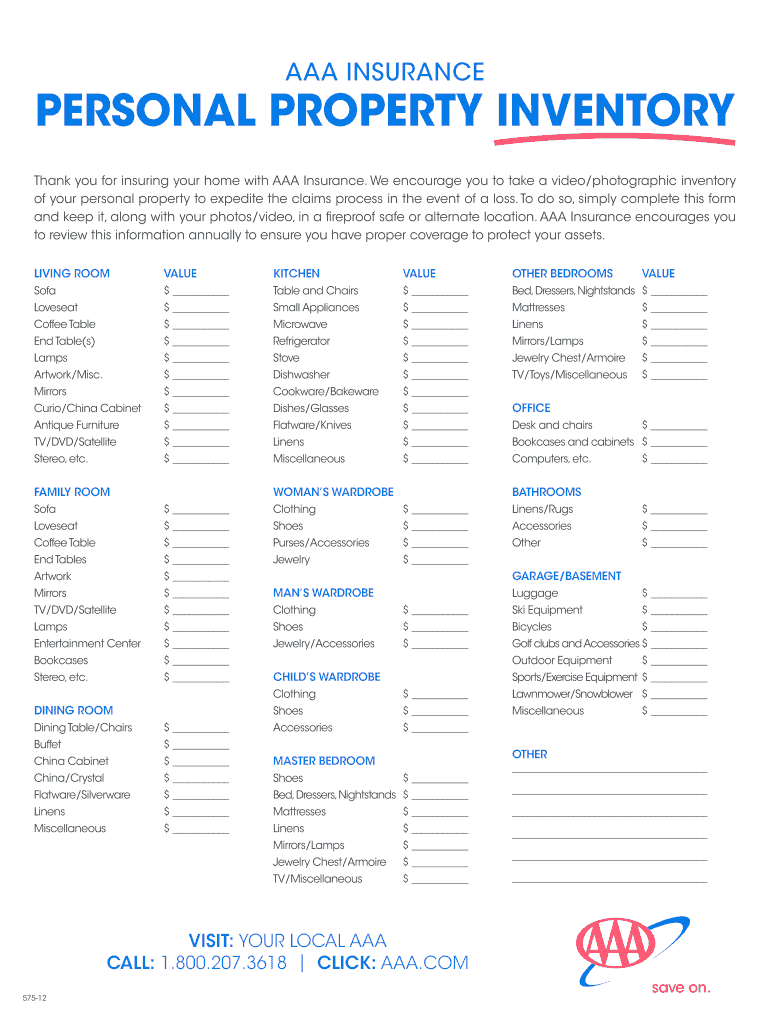

AAA Insurance 575-12 free printable template

Show details

DEPARTMENT OF THE TREASURY INTERNAL REVENUE SERVICE Washington, D.C. 20224 SMALL BUSINESS/SELF-EMPLOYED May 1, 2012, Control #: SBSE-04-0512-046 Affected IRM: 4.24.8.10.1 Expiration Date: May 01,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign total loss inventory list template form

Edit your house fire inventory list form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fire loss inventory list template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing itemized list for insurance claim online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fire loss inventory list form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fire loss inventory list pdf form

How to fill out AAA Insurance 575-12

01

Gather all necessary personal information, including your name, address, and contact details.

02

Review the instructions on the form for any specific requirements.

03

Fill in your policy number if you have one.

04

Provide information on any vehicles you wish to insure, including make, model, and year.

05

Indicate the coverage options you desire (e.g., liability, collision, comprehensive).

06

Review the deductibles for different coverage types and select your preferred amounts.

07

If applicable, include information about any additional drivers.

08

Double-check all entries for accuracy.

09

Sign and date the form where indicated.

10

Submit the completed form as per the instructions provided.

Who needs AAA Insurance 575-12?

01

Individuals looking for auto insurance coverage.

02

Drivers who need to fulfill state insurance requirements.

03

Those seeking to bundle insurance products for better rates.

04

People who require additional liability coverage for peace of mind.

Fill

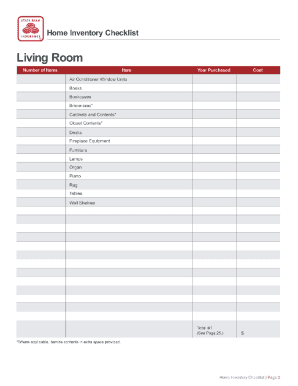

insurance home inventory printable

: Try Risk Free

People Also Ask about renters insurance inventory form

What are the three elements of property loss exposure?

The three components used to analyze property loss exposures allow for identification of the exposures in specific terms. For example, they may refer to a building exposure (type of property), a windstorm exposure (cause of loss), or a loss of business income exposure (financial consequence).

What is an example of physical loss?

Examples of Physical loss in a sentence Physical loss or damage by normal settling, shrinkage or expansion in building or foundation. Loss of Sight Physical loss of one or both eyes or the loss of a substantial part of the sight of one or both eyes.

What is the meaning of loss of property?

Loss of Property . ' shall mean the physical loss, damage or destruction of Property anywhere by any means by the Insured and which does not fall within the definition of Dishonest Act. Sample 1Sample 2. Loss of Property .

What is an example of property loss?

For example, an individual's belongings could be destroyed by a flood, or a family's home and its contents could be destroyed by a tornado. These situations, and many more, are loss exposures that individuals and families might face. Assets exposed to loss are any items of property that have value.

What is a loss report form?

Primary Purpose – The 1 form: Property Loss Notice, is used to document the personal lines property losses including Homeowners, Dwelling Fire, Inland. Marine, Commercial Property, Flood, Wind and others, happened to the insured locations so as to file a claim.

What is a statement of loss?

In the property insurance industry, a statement of loss is synonymous with a proof of loss. Whether your insurer calls it by one name or the other, the document is prepared by your insurer's claim adjuster to itemize your damaged goods that need replacement or repair after a disaster involving your business or home.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my total loss inventory list template excel in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your aaa form inventory and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send insurance inventory list for eSignature?

home insurance inventory list template is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out home insurance checklist using my mobile device?

Use the pdfFiller mobile app to fill out and sign fire loss spreadsheet. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is AAA Insurance 575-12?

AAA Insurance 575-12 is a specific form used for reporting information related to insurance policies and claims under the AAA Insurance framework.

Who is required to file AAA Insurance 575-12?

Individuals or businesses that hold AAA insurance policies and need to report specific information regarding their insurance claims or policies are required to file AAA Insurance 575-12.

How to fill out AAA Insurance 575-12?

To fill out AAA Insurance 575-12, you should carefully follow the instructions provided on the form, ensuring to enter accurate policy information, claim details, and any other required data as indicated.

What is the purpose of AAA Insurance 575-12?

The purpose of AAA Insurance 575-12 is to provide a standardized way for policyholders to report necessary information regarding their insurance coverage and claims to the insurance provider.

What information must be reported on AAA Insurance 575-12?

The information that must be reported on AAA Insurance 575-12 typically includes policyholder details, policy numbers, claim numbers, dates of the incidents, descriptions of the claims, and other relevant data as required by AAA Insurance.

Fill out your AAA Insurance 575-12 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Printable Inventory For Homeowners Policy is not the form you're looking for?Search for another form here.

Keywords relevant to insurance inventory list template

Related to fire inventory

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.